Economics 101

First, I want to point you to the ever brilliant Walter Williams' latest article "Minimum wage, maximum folly". If you are too lazy to go read it, here are a couple of highlights:The U.S. Department of Labor reports: "According to Current Population Survey estimates for 2004, some 73.9 million American workers were paid at hourly rates, representing 59.8 percent of all wage and salary workers. Of those paid by the hour, 520,000 were reported as earning exactly $5.15."520,000 out of 73.9 million is 0.7% for those of you without a calculator. So .7% of 59.8% of American workers currently work for minimum wage. That is 0.4186 % of the working population. Or to put it in terms that your average house plant could understand, for every 240 workers in the US economy there is one poor soul working for minimum wage.

The U.S. Department of Labor also reports that the "proportion of hourly-paid workers earning the prevailing Federal minimum wage or less has trended downward since 1979."So the market has naturally lifted once-minimum-wage workers to higher wages over time?

Professor Williams then goes on to make a brilliant point about how South African racists figured out what the effect was of having and moving a minimum wage and wonders how Oprah missed it. It is well worth a read.

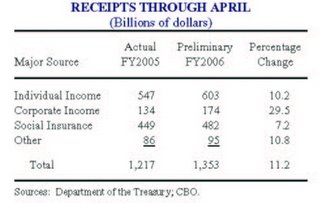

Next, Right Wing Wackos found this chart:

If you look closely at the Social Insurance numbers you will see the folly in this idea that "while the economy may be growing, wages are not". Truly "Rich People" don't pay much in the way of Social Insurance taxes. Their money is made off of investments which are classed as "unearned income". You could explain away the Corporate and Individual Income taxes by saying that the upper middle class and "Rich People" are making out like bandits but the little guy is getting hammered. That cannot explain a 7.2% increase in Social Insurance taxes paid. Those are disproportionately paid by lower and middle class workers as a percentage of income. Above the cutoff point in the middle class range the tax falls from ~16% to less than 3%.

Think about this chart the next time someone tells you that people aren't getting raises. I say this as someone who made less last year than a few years ago. Some market trends are too high, some too low, but in terms of general economics you have to look at overall trends.

0 Comments:

Post a Comment

<< Home